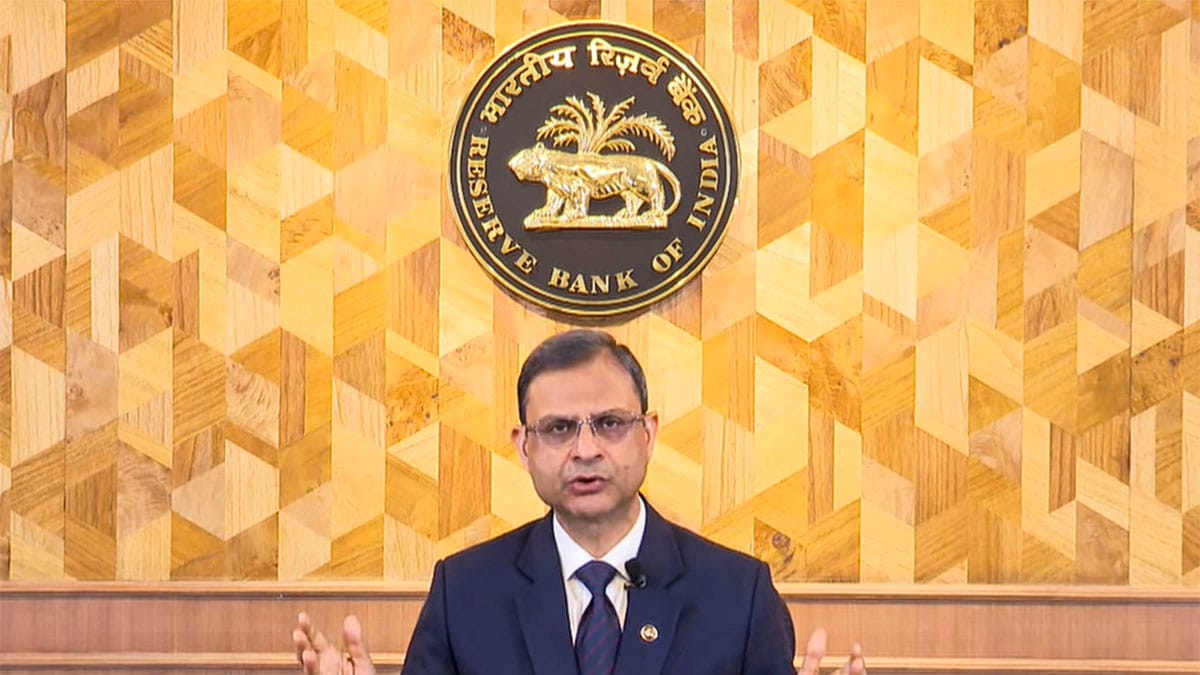

In its August 2025 monetary policy review, the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC), led by Governor Sanjay Malhotra, has decided to maintain the repo rate unchanged at 5.5%. This decision was announced on Wednesday, following a meeting of the MPC from August 4 to 6. The committee has also decided to continue with its neutral stance.

This decision comes after a 100 basis points (bps) cut in the repo rate since February 2025, with the last cut of 50 bps being announced in June. The MPC's decision to hold the rate steady reflects a cautious approach aimed at supporting domestic demand while carefully managing external risks.

The MPC's decision was influenced by several factors. Firstly, inflation has been easing, with the RBI projecting CPI inflation for 2025-26 at 3.1%, lower than the 3.7% estimated in June. Specifically, CPI inflation is expected to average 2.1% in Q2, 3.1% in Q3, and 4.4% in Q4 of FY26. For the first quarter of 2026-27, the RBI projects CPI inflation at 4.9%. Secondly, the global economic situation remains uncertain, particularly with the US imposing a 25% tariff on Indian imports. This has raised concerns about its potential impact on India's export push and GDP growth. Some experts estimate that GDP growth could take a hit of around 30 bps if the US tariff continues due to a trade deal stalemate.

Despite these uncertainties, the MPC has retained its GDP growth forecast for FY26 at 6.5%. The quarterly projections remain consistent: 6.5% for April-June 2025, 6.7% for July-September 2025, 6.6% for October-December 2025, and 6.3% for January-March 2026. For the first quarter of 2026-27, the RBI anticipates a GDP growth of 6.6%.

The decision to keep the repo rate unchanged has been met with mixed reactions. Some economists believe that a final 25 bps cut could further support growth, especially ahead of the festive season. However, others argue that maintaining the status quo is a prudent policy action, given the weakening Indian Rupee and narrowing global interest rate differentials. Praveen Sharma, CEO of REA India (Housing.com) noted that homebuyers are increasingly driven by long-term confidence rather than short-term rate fluctuations.

The MPC's meeting also included a review of India's foreign exchange reserves, which have risen to $698.19 billion, the highest in 11 months. This increase, according to Governor Malhotra, comes at a time of steady merchandise exports. The central bank continues to closely monitor the forex market, intervening only to curb excessive volatility and not targeting any specific exchange rate level.

In addition to the repo rate, the standing deposit facility (SDF) rate remains unchanged at 5.25%, while the marginal standing facility (MSF) rate and the Bank Rate stay at 5.75%. The cash reserve ratio (CRR) remains at 3%. The MPC members who attended the meeting included Dr. Nagesh Kumar, Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta, and Dr. Rajiv Ranjan.