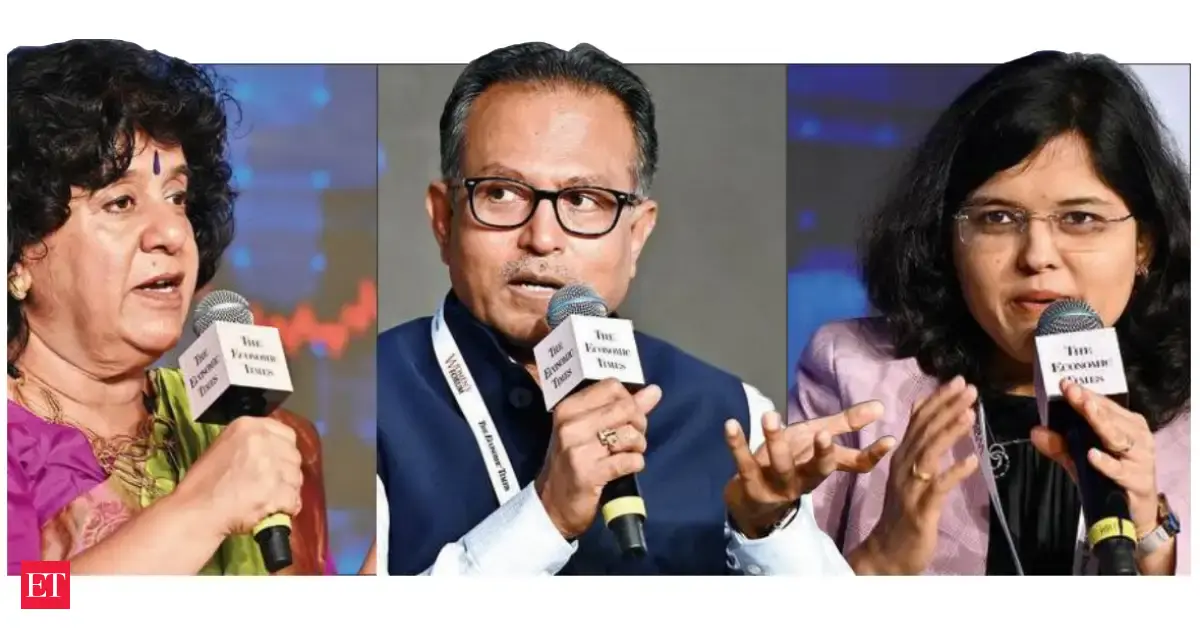

The Economic Times Women's Forum recently hosted a compelling discussion emphasizing that financial independence is a cornerstone of empowerment, enabling women to take control of their lives. Experts at the forum underscored the critical need for enhanced financial literacy among women, advocating for a shift in societal norms to encourage active participation in investment decisions, regardless of their educational background or perceived expertise.

The core message resonated with the idea that women don't need a finance degree or a financial guru to begin their journey toward financial freedom. Instead, the forum encouraged women to adopt a simple yet effective approach: start with small, consistent steps, much like taking a "SIP" (Systematic Investment Plan) of confidence. This involves challenging the intimidation factor often associated with finance and embracing the learning process. The speakers highlighted that even small, regular investments can accumulate significantly over time, paving the way for long-term financial security and independence.

The discussions revolved around practical strategies and actionable advice. One key point was the importance of budgeting and understanding personal cash flow. Women were encouraged to track their income and expenses to identify areas where they could save and invest. The forum also addressed the significance of setting clear financial goals, whether it's saving for retirement, buying a home, or starting a business. By defining their objectives, women can create a roadmap for their financial journey and stay motivated along the way.

Moreover, the ET Women's Forum tackled the societal and psychological barriers that often prevent women from engaging with finance. Traditional gender roles and the perception that finance is a male-dominated domain can create a sense of apprehension. The speakers emphasized the need to dismantle these stereotypes and create a more inclusive environment where women feel empowered to learn and make informed financial decisions. They stressed that financial literacy is not about complex calculations or advanced degrees; it's about understanding the basic principles of money management and having the confidence to apply them.

The forum also showcased success stories of women who have achieved financial independence through self-education and determination. These stories served as inspiration, demonstrating that it's possible to overcome challenges and build a secure financial future, regardless of one's starting point. The emphasis was on learning from peers, seeking advice from trusted sources, and utilizing available resources, such as online courses and financial planning tools.

In essence, the ET Women's Forum championed the idea that financial independence is not an exclusive club for the elite but a right that every woman can and should claim. By taking a "SIP of confidence" and starting the "walk to freedom," women can break free from financial constraints, achieve their goals, and live life on their own terms. The forum served as a powerful reminder that financial literacy, combined with a proactive mindset, is the key to unlocking a future of security, opportunity, and empowerment for women everywhere.