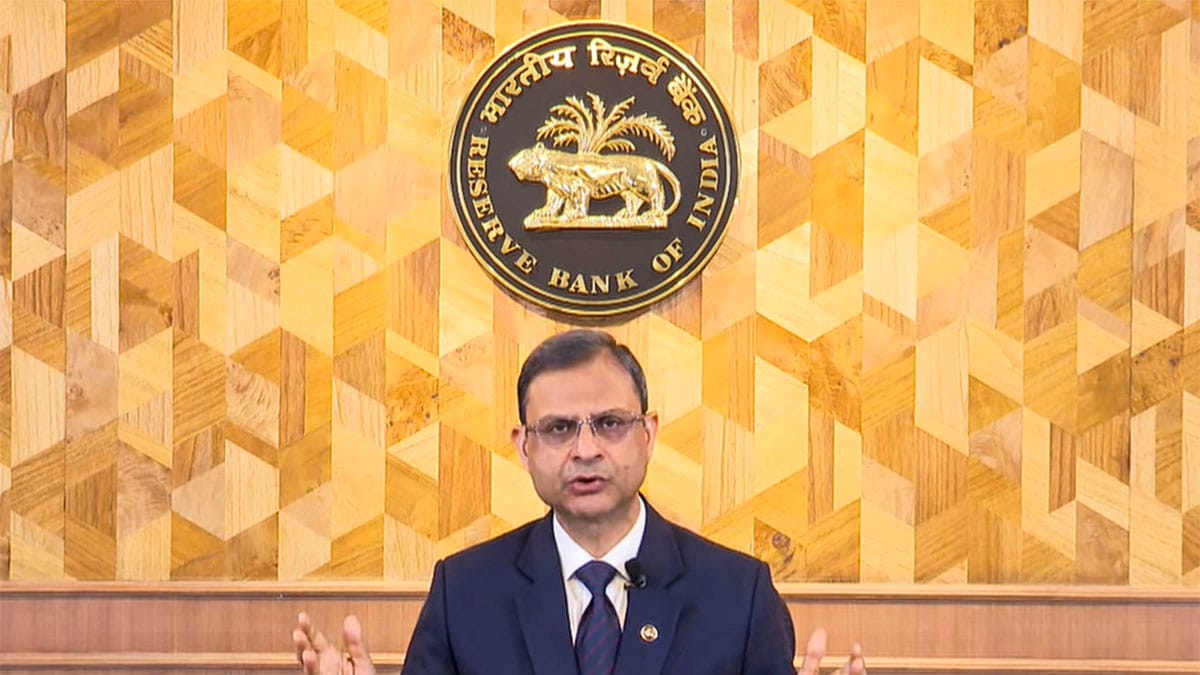

The Reserve Bank of India (RBI) has slashed the repo rate by 50 basis points, bringing it down to 5.50% from 6.00%. This move, announced on June 6, 2025, marks the third consecutive rate cut by the central bank since February 2025, signaling a continued effort to bolster economic growth amid global headwinds. The decision was made by the Monetary Policy Committee (MPC), led by Governor Sanjay Malhotra, following a three-day meeting that commenced on June 4, 2025.

The MPC's decision is particularly significant as it comes against a backdrop of moderating inflation and a need to support domestic demand. The RBI has revised its inflation forecast downwards to 3.7% for FY26, compared to the earlier projection of 4%. This revised outlook, coupled with a benign outlook on food and core inflation, provides the central bank with greater flexibility to implement rate cuts aimed at stimulating economic activity.

The rate cut is expected to have several positive impacts on the Indian economy. Firstly, it is likely to bring down Equated Monthly Installments (EMIs) for borrowers, providing relief to individuals and businesses with outstanding loans. This reduction in borrowing costs is anticipated to spur consumption and investment, thereby boosting economic growth. Secondly, the rate cut is expected to benefit the bond market, as falling interest rates typically lead to a rise in bond prices.

In addition to the repo rate cut, the RBI also announced a reduction in the Cash Reserve Ratio (CRR) by 100 basis points, bringing it down to 3%. This measure is intended to further enhance liquidity in the banking system, enabling banks to lend more freely and support economic activity.

While the RBI has been proactive in addressing domestic economic concerns, it remains mindful of global challenges. Governor Sanjay Malhotra acknowledged that "global growth and trade projections have been revised downward" and that the "growth-inflation trade-off is becoming more challenging." The central bank has retained its GDP growth forecast for FY26 at 6.5%, indicating a cautious outlook in light of global uncertainties and geopolitical tensions.

The MPC has also decided to change its stance from 'accommodative' to 'neutral'. This shift suggests that the central bank believes it has limited space to further support growth through monetary policy and intends to adopt a more balanced approach, closely monitoring both inflation and growth dynamics.

Experts believe that the RBI's move is a well-calibrated response to the current economic situation. Dr. Manoranjan Sharma, Chief Economist at Infomerics Valuations and Ratings, had earlier indicated that the likelihood of a normal monsoon would prompt the RBI to cut policy rates. A normal monsoon is crucial for the Indian economy, as it rejuvenates aquifers and reservoirs, supports agriculture, and boosts rural demand.

Overall, the RBI's decision to slash the repo rate by 50 basis points is a significant step towards supporting economic growth in India. The central bank's proactive approach, combined with its prudent assessment of both domestic and global factors, is expected to create a more conducive environment for investment, consumption, and overall economic activity.