The dramatic downfall of Byju's continues as the edtech giant has been forced to sell its US-based subsidiaries, Epic and Tynker, at a massive loss. What was once a $700 million investment has now shrunk to a mere $97.2 million, highlighting the severity of the financial crisis engulfing the company. The fire sale of these assets is a desperate attempt to repay a portion of a $1.2 billion term loan that Byju's took out to fuel its global expansion.

In 2021, during the peak of the pandemic-driven online learning boom, Byju's acquired Epic, a children's reading platform, for $500 million and Tynker, a coding platform for kids, for $200 million. These acquisitions were part of an ambitious plan to establish a strong presence in the US market. However, Byju's rapid expansion, fueled by significant debt, has now backfired spectacularly.

The Delaware bankruptcy court has approved the sale of Epic to China's TAL Education Group for $95 million, a staggering 81% discount from its original purchase price. Tynker was acquired by CodeHS, a computer science education firm, for a paltry $2.2 million, a 99% reduction from the $200 million Byju's paid for it. These transactions highlight the distressed state of Byju's and the challenges it faces in repaying its debts.

The $1.2 billion term loan, routed through Byju's US arm Alpha, is at the center of a complex web of lawsuits, allegations of fraudulent transfers, and director misconduct. Byju's defaulted on this loan over 17 months ago, leading to multiple legal battles with its lenders. The sale of Epic and Tynker is intended to recover a portion of this debt, but the significant losses incurred in the process underscore the financial mismanagement and strategic missteps that have plagued Byju's.

The troubles for Byju's are not limited to the US. In India, the company is facing insolvency proceedings, auditor resignations, and a sharp erosion of investor confidence. Once valued at $22 billion, Byju's valuation is now estimated to have plummeted below $1 billion. The company has yet to file its audited financial reports for FY23, FY24, and FY25, raising further concerns about its financial transparency.

The fire sale of Epic and Tynker serves as a cautionary tale for the Indian startup ecosystem. It raises critical questions about the sustainability of aggressive valuations, the wisdom of rapid expansion strategies, and the importance of robust financial governance. The story of Byju's, once a symbol of Indian entrepreneurial success, now illustrates the risks of unchecked ambition and the harsh realities of the market.

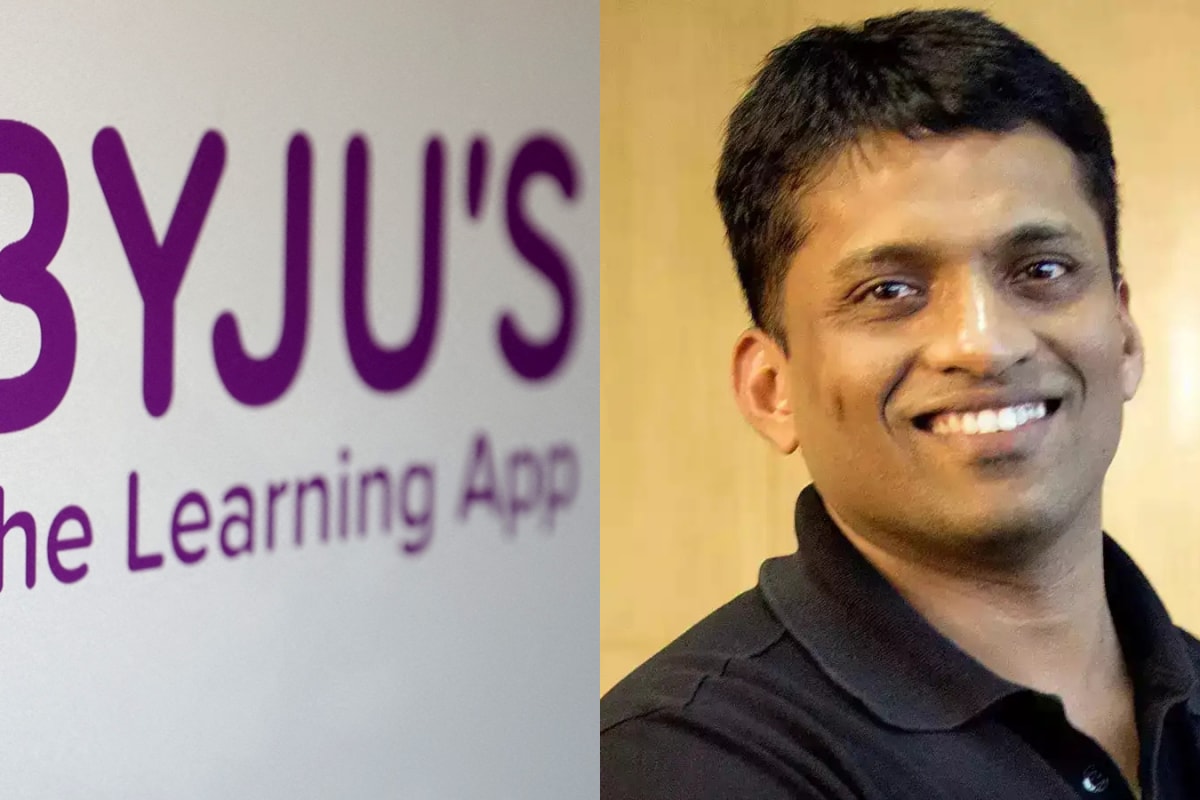

While Byju Raveendran, the founder of Byju's, has expressed optimism about overcoming these challenges and launching "Byju's 3.0," the road ahead appears to be fraught with difficulties. The company faces ongoing litigation, investor exits, and app outages, while subsidiaries like Aakash and Great Learning are distancing themselves from the parent company.

The sale of Epic and Tynker marks a significant setback for Byju's and highlights the challenges of building a sustainable and profitable edtech business. As the company navigates its financial crisis, it must address its governance issues, improve its financial transparency, and focus on sustainable growth to regain the trust of investors and customers.