The US Federal Reserve (Fed) has decided to keep interest rates unchanged for the fourth consecutive time at its June 18, 2025, meeting, maintaining the benchmark federal funds rate in a target range of 4.25% to 4.50%. This decision aligns with widespread expectations, as the central bank continues to assess the economic landscape amidst uncertainties surrounding inflation, labor market conditions, and the potential impacts of the Trump administration's policies, particularly concerning tariffs, immigration, and taxation.

While holding steady on rates, the Fed's latest Summary of Economic Projections (SEP), including the closely watched "dot plot," suggests that policymakers still anticipate two 0.25 percentage point rate cuts before the end of the year. This indicates a continued, albeit cautious, approach to monetary easing. However, this projection is not set in stone, as several factors could influence the Fed's future decisions.

Several key factors influenced the Fed's decision to maintain the status quo. Recent economic data presents a mixed picture, with inflation moderating but still remaining above the Fed's 2% target. The labor market demonstrates resilience, but there are signs of slowing job growth. Moreover, the economic outlook is clouded by uncertainty related to trade policies and geopolitical tensions, particularly concerning the Israel-Iran conflict, which has led to increased oil prices and fears of renewed inflationary pressures.

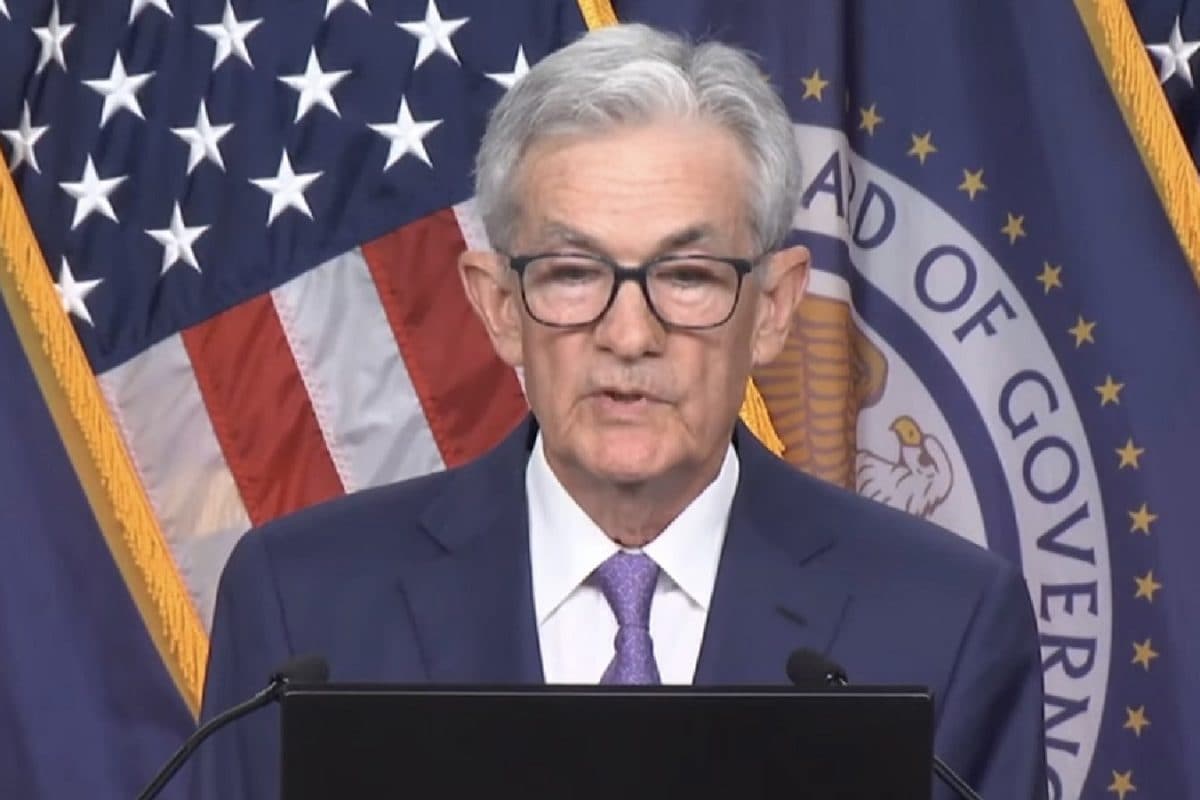

Chairman Jerome Powell emphasized the need for "greater confidence" that inflation is firmly on track to reach the 2% target before committing to rate cuts. This cautious approach reflects the Fed's commitment to avoiding a premature easing of monetary policy that could reignite inflationary pressures.

The Fed's projections for future rate cuts are subject to change based on evolving economic conditions. The "dot plot," which represents each Federal Reserve official's expectations for future interest rates, will be closely scrutinized for any shifts in sentiment. Some analysts suggest that the Fed might reduce the number of projected rate cuts to one or potentially push them further into 2026.

The Fed's decisions have implications for consumers and businesses alike. Holding rates steady is welcome news for savers who benefit from higher interest rates on savings accounts and certificates of deposit (CDs). However, borrowers may have to wait longer for lower borrowing costs on mortgages, auto loans, and other forms of credit.

Looking ahead, the Fed will continue to carefully monitor economic data, including inflation, labor market indicators, and global economic developments. The central bank has reiterated its commitment to data dependency, meaning that future policy decisions will be guided by incoming information and the evolving economic outlook. The next key indicator to watch will be the GDP growth and inflation. While a rebound is expected in the second quarter of 2025 (+0.9% q/q), the average annual growth rate should lower to +1.7% for the year. Changes in economic policy should lead to a rise in inflation, up to +3.5% a/a in Q2-2026.