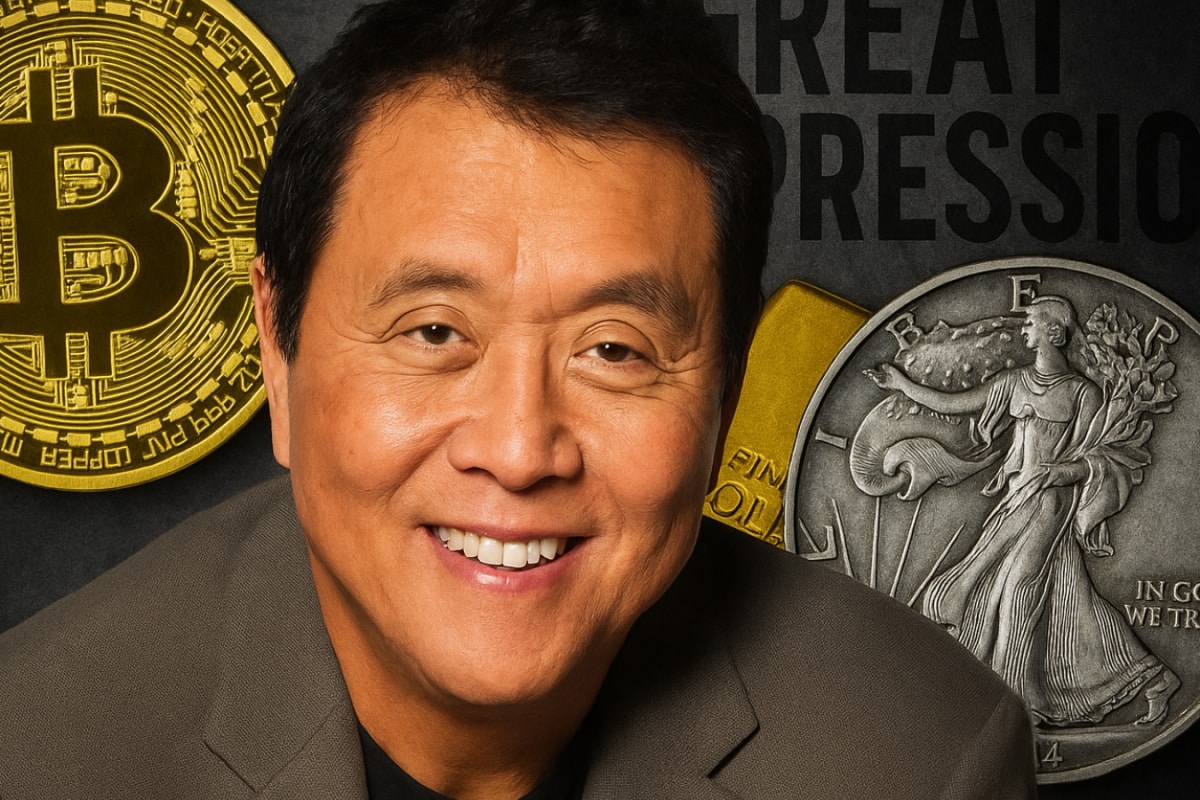

Robert Kiyosaki, the author of "Rich Dad Poor Dad," has predicted a potential surge in silver prices in July 2025, describing silver as the "best asymmetric buy". This perspective aligns with a broader sentiment among analysts who anticipate a bullish trend for silver, driven by increasing industrial demand, supply constraints, and its role as a safe-haven asset.

Factors Driving Silver's Potential Surge

Several key factors contribute to the optimistic outlook for silver in 2025:

Expert Predictions and Market Analysis

Robert Kiyosaki's prediction of a silver price surge in July 2025 is echoed by other analysts. Indian analysts also share this sentiment, citing escalating geopolitical tensions and increasing industrial demand, especially in EVs and solar energy.

Naveen Mathur, Director – Commodities & Currencies at Anand Rathi Shares and Stock Brokers, highlighted silver's breakout to 13-year highs, attributing the rally to industrial buying, safe-haven demand, and trade-related uncertainties. He anticipates silver outperforming gold in the second half of 2025, projecting a trading range of $38.70–$41.50 per ounce.

Jigar Trivedi, Senior Research Analyst – Currencies & Commodities at Reliance Securities, noted silver's unique position due to its growing industrial demand amid geopolitical tensions and trade uncertainties. He projected that COMEX silver could rise to $36–$37 per ounce, while MCX silver could reach Rs 1,10,000 per kg within a month.

Alan Hibbard, GoldSilver's Lead Analyst, expects silver to return about 25% in 2025, putting it around $40 and anticipates silver reaching an all-time high above $52.50 in 2026.

Potential Price Targets

Factors to Watch

While the outlook for silver appears bullish, investors should monitor several factors that could influence its price:

Investment Strategies

Given the potential for silver price appreciation, Kiyosaki advises investors to buy silver now, while it is still affordable. He also suggests investors to consider precious metals and real estate as assets that can bring great wealth during economic turmoil. Some analysts recommend a buy-on-dips strategy, viewing pullbacks as buying opportunities. Diversified allocation with 12–15% in silver has also been suggested.