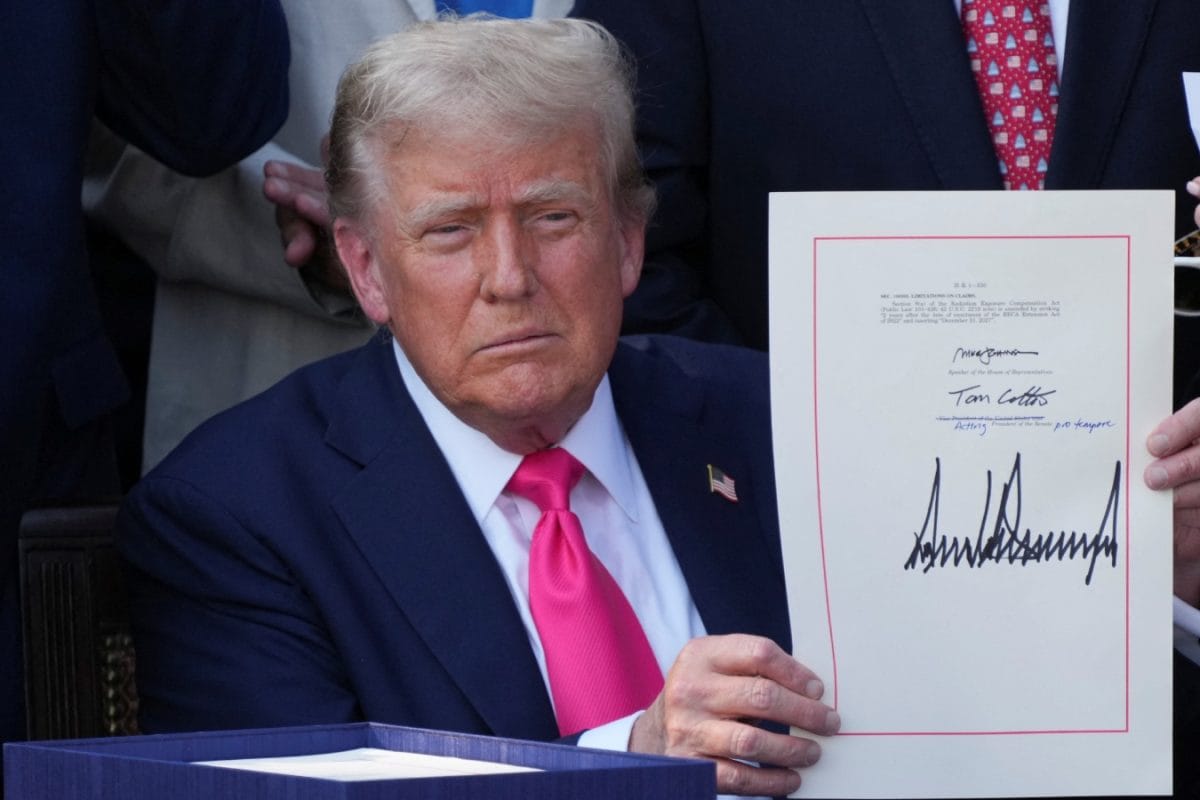

The "One Big Beautiful Bill Act" recently passed by the U.S. Congress and signed into law by President Trump, brings both relief and new considerations for Non-Resident Indians (NRIs) who regularly send money to India. The bill, which has undergone several revisions, introduces a new tax on remittances sent from the U.S. to other countries, including India. While the initial proposal вызвал concerns among the Indian diaspora, the final version offers some significant concessions.

Key Provisions Affecting NRIs:

- Reduced Remittance Tax: The original proposal of a 5% tax on remittances was significantly reduced to 1% in the final version of the bill. This decrease offers considerable relief to NRIs who send money home to support families, invest in property, or contribute to Non-Resident External (NRE) or Non-Resident Ordinary (NRO) accounts.

- Exemptions for Common Transfer Methods: Crucially, the new law exempts transfers made from U.S. bank accounts and those funded with U.S.-issued debit or credit cards. This means that a large proportion of day-to-day remittances made through mainstream channels like Wise, Remitly, ICICI Money2India, or direct bank wire transfers will likely fall outside the scope of the new tax.

- Effective Date: The remittance tax applies only to transfers made after December 31, 2025. This gives NRIs time to plan their financial transactions and adjust their remittance methods accordingly.

- Who is impacted: The 1% remittance tax applies to non-citizens, including those on H-1B, L-1, or O-1 visas, Green Card holders, and students on F1/OPT visas.

- Taxable Remittances: The tax applies to remittances made through cash, money orders, or cashier's checks. Possible taxable remittances include real estate investments, NRE/NRO deposits, family support, and money from stock options or sale of assets.

Impact and Planning for NRIs:

- Financial Planning: NRIs should review their financial plans to account for the new tax, especially if they make high-value or recurrent transfers using non-exempt methods.

- Remittance Strategies: To avoid the tax, NRIs can prioritize using bank transfers or U.S.-issued cards for remittances. They can also plan large transfers before the end of 2025.

- Tax Credits: NRIs should continue to record and pay capital gains tax on the sale of Indian property and can claim a foreign tax credit for taxes paid in India to avoid double taxation on the same income.

Broader Implications of the "One Big Beautiful Bill Act":

Beyond remittances, the "One Big Beautiful Bill Act" encompasses a wide range of policy changes, including tax cuts, increased military spending, and adjustments to social safety net programs. Some key aspects include:

- Tax Cuts: The law extends tax cuts from President Trump's first term, benefiting higher-income earners. It also raises the cap on deductible local taxes and allows deductions for income earned from tips and overtime.

- Border Security: The bill allocates additional funds towards immigration control and border security efforts.

- Social Programs: The legislation includes cuts to Medicaid and the Supplemental Nutrition Assistance Program (SNAP), which could impact low-income individuals and families.

The "One Big Beautiful Bill Act" represents a significant piece of legislation with varied implications. For NRIs sending money to India, the reduction of the remittance tax and the exemptions for common transfer methods offer considerable relief. However, it remains crucial to understand the specific provisions of the law and plan financial transactions accordingly to minimize the impact of the new tax.