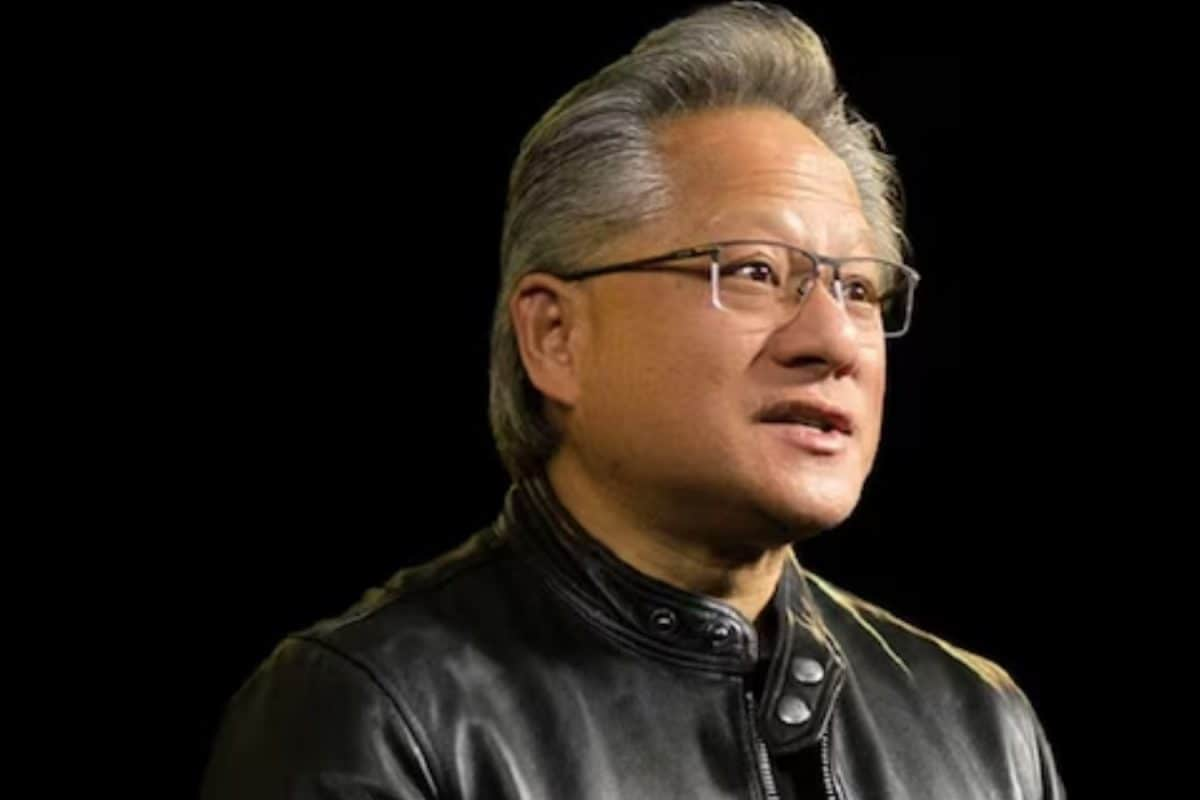

Nvidia's groundbreaking surge to a $4 trillion market capitalization has significantly boosted the net worth of its co-founder and CEO, Jensen Huang. As of July 9, 2025, Huang's net worth is estimated to be over $140 billion, placing him among the top 10 richest individuals in the world. This financial milestone is a direct result of Nvidia's exceptional performance in the artificial intelligence (AI) sector, where its chips have become indispensable.

Nvidia's journey to becoming the first publicly traded company to reach a $4 trillion valuation is a testament to the increasing importance of AI in the global economy. The company's stock has seen substantial growth, with shares rising as high as $164.42 on Wednesday. This surge reflects the market's strong confidence in AI's future and Nvidia's pivotal role in driving this technological revolution. Nvidia's graphics processing units (GPUs) are the backbone of many generative AI programs, finding applications in autonomous driving, robotics, and various other cutting-edge fields.

Huang's leadership and vision have been instrumental in Nvidia's success. His 3.5% ownership stake in the company has made him the largest shareholder, directly linking his personal wealth to Nvidia's market performance. Over the past few years, Huang's net worth has seen exponential growth, climbing from $20.6 billion in 2022 to $44 billion in 2023, $117 billion in 2024, and now exceeding $140 billion. This remarkable ascent mirrors Nvidia's own trajectory, with its market capitalization soaring from $1.05 trillion in July 2023 to $4 trillion in July 2025.

Nvidia's dominance in the AI chip market has allowed it to outperform tech giants like Microsoft and Apple. The company's revenue for the first quarter of 2025 was nearly $19 billion, despite a $4.5 billion impact from U.S. export controls. This impressive performance underscores Nvidia's ability to navigate challenges and capitalize on the growing demand for its products. Looking ahead, Nvidia anticipates revenue of $45 billion for the second quarter, further solidifying its position as a leader in the semiconductor industry.

While Nvidia's stock experienced a sluggish start to 2025 due to factors such as the emergence of a Chinese discount AI model and broader macroeconomic pressures, the company quickly rebounded. By late May, Nvidia had delivered another strong quarter, driven by an $18.8 billion profit. This resilience highlights Nvidia's robust business model and its capacity to adapt to changing market conditions.

Analysts remain optimistic about Nvidia's future, with many forecasting continued growth and profitability. The consensus among Wall Street analysts is a "Strong Buy" rating for Nvidia stock, with a median one-year price target of $175.97. This positive outlook reflects confidence in Nvidia's ability to maintain its leadership in the AI space and drive further innovation.

Jensen Huang's journey from a busboy at Denny's to the CEO of a $4 trillion company is an inspiring success story. His strategic vision and technological expertise have transformed Nvidia into a global powerhouse, shaping the future of AI and revolutionizing industries worldwide. As Nvidia continues to push the boundaries of what's possible, Jensen Huang's legacy as a visionary leader and innovator is firmly cemented.