Amidst rising global discussions on de-dollarization and threats of tariffs from former U.S. President Donald Trump, India has clarified that de-dollarization is not part of its financial agenda. This statement comes in response to concerns that India, along with other BRICS nations, might be seeking to undermine the dominance of the U.S. dollar in international trade.

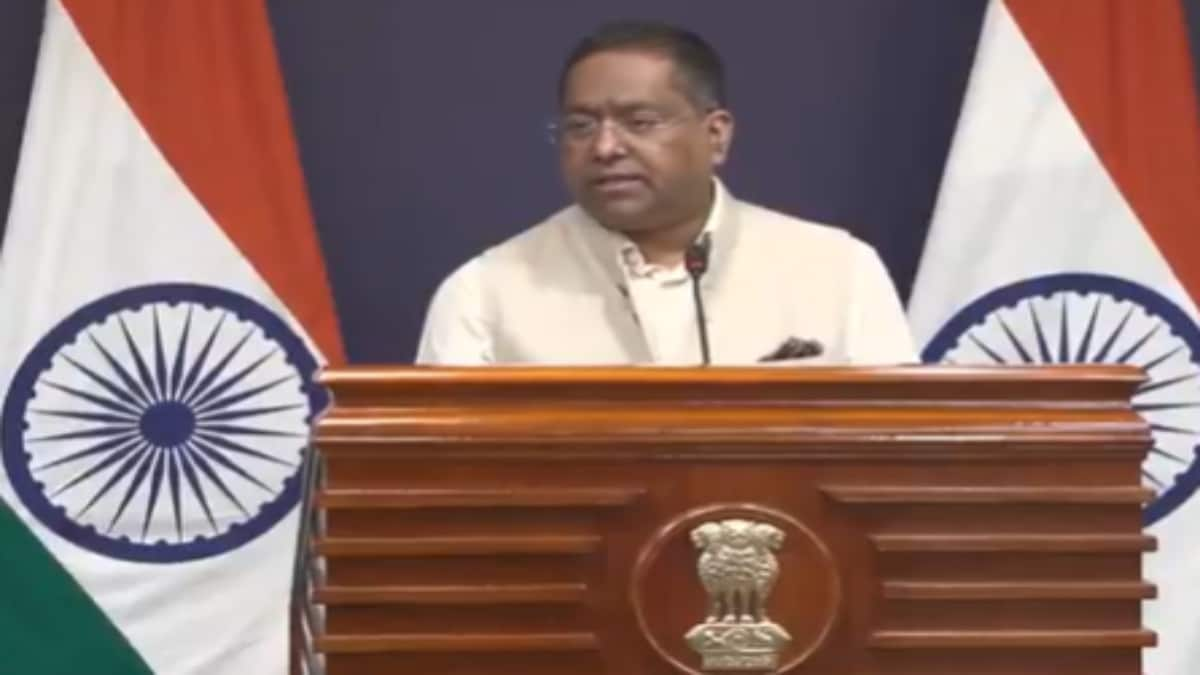

Ministry of External Affairs Spokesperson Randhir Jaiswal stated that while BRICS nations are discussing cross-border payments in local currencies, de-dollarization is not on the agenda. This position aligns with India's broader strategy of promoting a diversified currency approach while maintaining strong ties with Western financial systems. External Affairs Minister S. Jaishankar has consistently emphasized the U.S. dollar's role in global financial stability.

The concept of de-dollarization has gained traction recently, with some viewing it as a challenge to the dollar's dominance. Trump had previously threatened BRICS nations, including India, with high tariffs if they attempted to replace the U.S. dollar.

Despite not pursuing de-dollarization, India has been exploring the use of local currencies for international trade. The Reserve Bank of India (RBI) has introduced a system allowing global trade payments in Rupees, streamlining cross-border transactions. This system allows foreign institutions to open Vostro accounts without central bank approval, reducing reliance on the U.S. dollar. As of August 2025, 156 accounts across 26 Indian banks facilitate these transactions.

This move towards using local currencies can be seen as a way to mitigate risks associated with global monetary policy shifts, sanctions, and currency shortages. It also aims to reduce exchange rate risk for Indian exporters and importers.

India's approach is carefully balanced. While participating in discussions about reducing the dollar's dominance within BRICS, New Delhi has avoided framing its Rupee settlement system as a direct de-dollarization effort. This reflects India's aim for strategic autonomy and a multi-polar global order, while also recognizing the importance of the U.S. in the global financial landscape.

However, India's relationship with the U.S. has faced some challenges. Trump's administration had deferred imposing additional tariffs on India, allowing more time for bilateral trade deal negotiations. Despite these challenges, India and the U.S. have committed to expanding bilateral trade to $500 billion by 2030.

Furthermore, there have been reports of the U.S. Treasury Secretary suggesting that India could face higher tariffs if talks between Russia and the U.S. fail, due to India's purchase of Russian oil. India has also faced scrutiny for its defense cooperation with Russia and its purchase of Russian oil, despite sanctions.

Despite these complexities, India remains focused on its substantive agenda with the U.S., hoping that the relationship will continue to move forward based on mutual respect and shared interests. India is committed to its purchases of military equipment from the U.S. as per established procedures.

In conclusion, while India is not actively pursuing de-dollarization, it is exploring alternative payment mechanisms and promoting the use of local currencies for trade. This approach reflects India's desire for strategic autonomy and a diversified currency strategy, while maintaining its relationship with the U.S. and navigating the complexities of the global economic landscape.