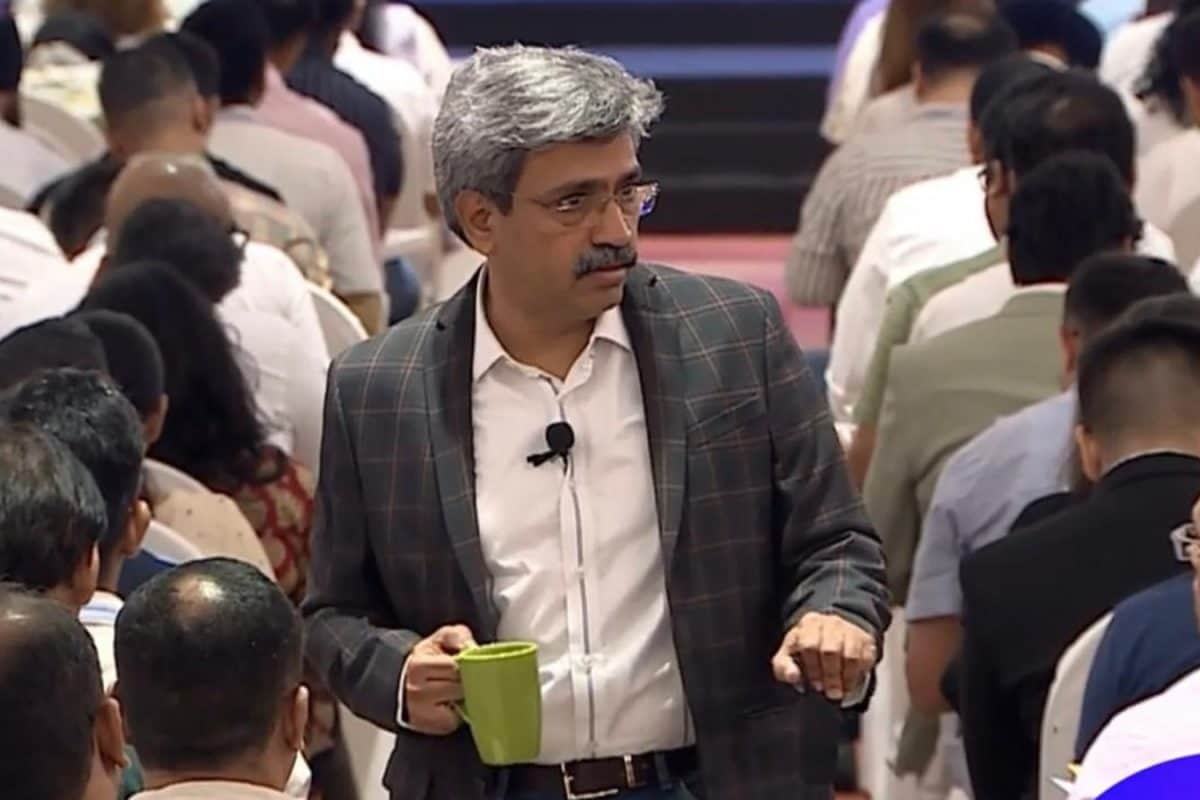

Avadhut Sathe is a prominent figure in India's "finfluencer" landscape, known for his trading lessons and market mentorship. He is the owner of Avadhut Sathe Trading Academy (ASTA), launched in 2015, and has been associated with Sadhan Advisors since 2010. His YouTube channel boasts nearly 940,000 subscribers, drawn to his unique teaching style that incorporates theatrical elements. However, Sathe has recently come under scrutiny from the Securities and Exchange Board of India (SEBI) due to concerns over unregistered advisory services and alleged market manipulation.

SEBI conducted a search and seizure operation at Sathe's Karjat academy on August 20, 2025, as part of a broader crackdown on financial influencers. The operation, which lasted over 36 hours, involved the seizure of digital devices and trading data for forensic analysis. SEBI suspects Sathe of offering unregistered investment advisory services, with alleged illegal gains estimated to be between Rs 400 crore and Rs 500 crore.

Sathe's journey began in a Dadar chawl in Mumbai. He holds an engineering degree and started his career in the software industry, working at Hexaware Technologies before moving abroad to Singapore, Australia, and the United States. After a stint in Silicon Valley, he returned to India and shifted his focus to trading and teaching full-time. In 2008, he conducted his first seminar in a small banquet hall with 12 attendees. From those humble beginnings, ASTA has expanded to train thousands across India. His courses, which include four modules spread over four months, combine live trading, mentorship, and technical analysis.

SEBI's investigation is centered on potential violations of regulations prohibiting investment advice or trading recommendations without proper registration. There are concerns that Sathe may have been promoting specific stocks, including penny stocks, to his students under the guise of education, which could potentially inflate prices and benefit market operators.

SEBI Whole-Time Member Kamlesh Chandra Varshney confirmed that a search operation had been conducted on a prominent financial influencer, emphasizing the regulator's zero-tolerance stance against misleading retail investors. He clarified that while genuine investor education is welcome, offering guaranteed returns or using live market data without registration is prohibited.

The raid on Sathe's academy underscores SEBI's growing focus on regulating the finfluencer ecosystem. The regulator aims to create a deterrent effect in a booming influencer-driven trading culture, where many unregistered individuals offer paid workshops and strategies to retail investors. By targeting unauthorized stock promotion methods and unregistered education, SEBI is reinforcing the need for compliance and investor protection.

The investigation into Sathe is ongoing, and SEBI has yet to release an official order. The case highlights the blurring lines between mentorship and advisory services in India's finfluencer community and the increasing regulatory scrutiny it faces.