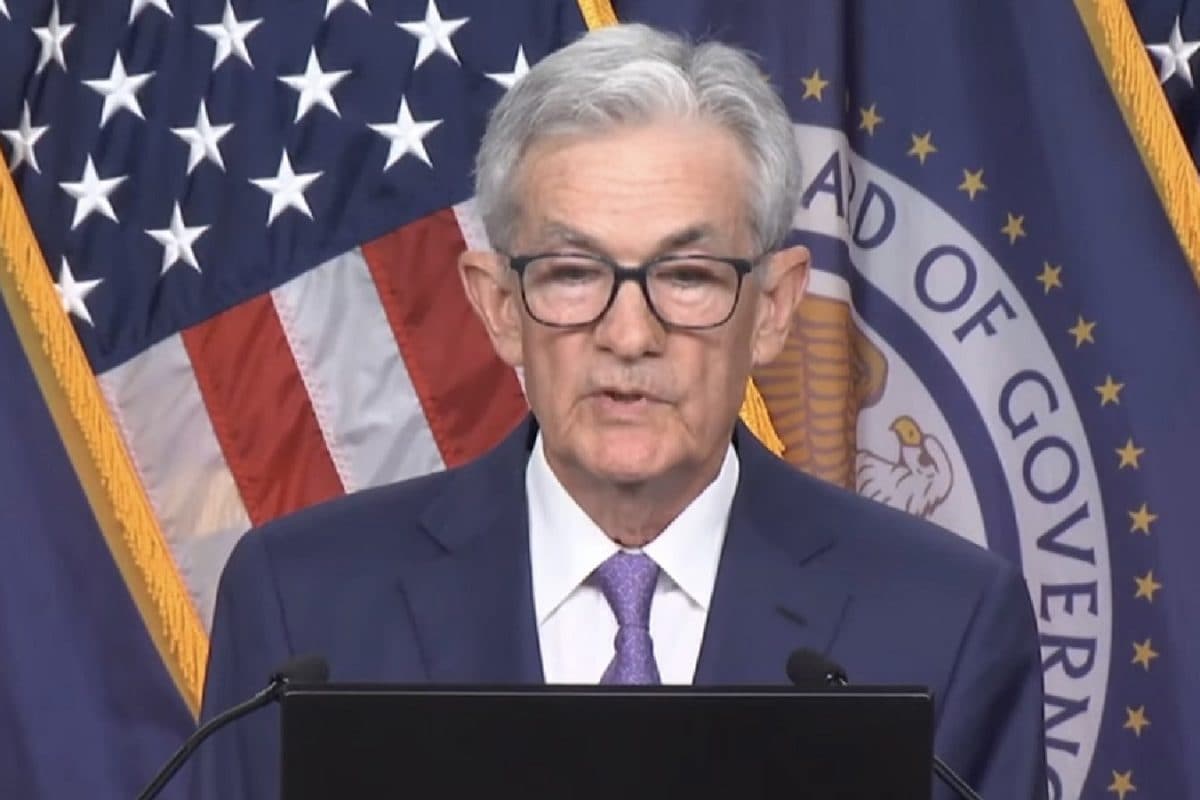

The Federal Reserve's Federal Open Market Committee (FOMC) is concluding its two-day policy meeting today, May 7, 2025, with the announcement due at 2 p.m. EDT, followed by a press conference with Fed Chair Jerome Powell at 2:30 p.m. The central question on everyone's mind: Will Powell bow to President Trump's persistent pressure for interest rate cuts?

The Pressure from the President

President Trump has been increasingly vocal in his criticism of the Federal Reserve, urging them to cut interest rates to stimulate the economy. He has gone as far as to call Powell "Mr. Too Late," a "total stiff" and a "major loser" for not lowering rates sooner. Trump argues that inflation has cooled sufficiently, making high borrowing costs unnecessary. He has also claimed that his administration's economic policies are being undermined by the Fed's inaction. Despite Trump's continued pressure, Powell has maintained that the Fed's decisions will be based solely on what is best for the American people, emphasizing the central bank's independence from political influence. Powell has stated that the Fed will not be influenced by any political pressure, as their independence is a matter of law.

The Economic Context

The Fed's meeting occurs during a period of mixed economic signals. While the labor market has remained relatively strong, with the economy adding 177,000 jobs in April and the unemployment rate holding steady at 4.2%, GDP unexpectedly fell into negative territory in the first quarter. Inflation, while having moderated from its peak in 2022, remains above the Fed's 2% target. Furthermore, there is considerable uncertainty surrounding the economic impact of President Trump's tariffs on imported goods. These tariffs could lead to higher consumer prices and potentially slow down economic growth.

Analyst Expectations

The overwhelming consensus among economists and investors is that the Fed will hold interest rates steady at this meeting, remaining in a range of 4.25% to 4.5%. The CME Group's FedWatch Tool, which tracks contracts linked to Fed policy, puts the odds of a hold at 97%. Economists at major investment banks like J.P. Morgan, Goldman Sachs, and Bank of America also predict that the Fed will maintain its current stance.

Analysts believe that the Fed will likely take a "wait-and-see" approach, assessing the impact of the Trump administration's trade policies and monitoring incoming economic data before making any adjustments to monetary policy. Powell has repeatedly signaled that he prioritizes curbing inflation, adding complexity to the Fed's dual mission of promoting maximum employment and ensuring price stability.

Potential Future Moves

While a rate cut is not expected today, the question remains: when will the Fed begin to ease monetary policy? Futures markets are currently pricing in a greater likelihood of a rate cut at the Fed's July meeting. Some economists anticipate two to three rate cuts by the end of the year, while others foresee the first cut occurring later in the year. Goldman Sachs projects rate cuts of 25 basis points each at the July, September, and October meetings. The timing and pace of future rate cuts will depend heavily on the evolution of inflation, the strength of the labor market, and the impact of trade policies on the U.S. economy.