The Jammu and Kashmir (J&K) government, along with local businesses, are advocating for a reduction in the Goods and Services Tax (GST) on handicraft items, proposing a uniform rate of 5%. This request highlights the importance of the handicraft sector in the region's economy and its significant contribution to employment.

J&K's handicraft industry is known for its vibrant, handmade crafts that symbolize the region's cultural heritage. Artisans in J&K have mastered the creation of various items, including carpets, shawls, wood carvings, and papier-mâché products. These crafts are not only culturally significant but also economically vital, providing livelihoods for a large number of local people. The sector is labor-intensive and less capital-intensive, making it particularly well-suited to the region's economic structure.

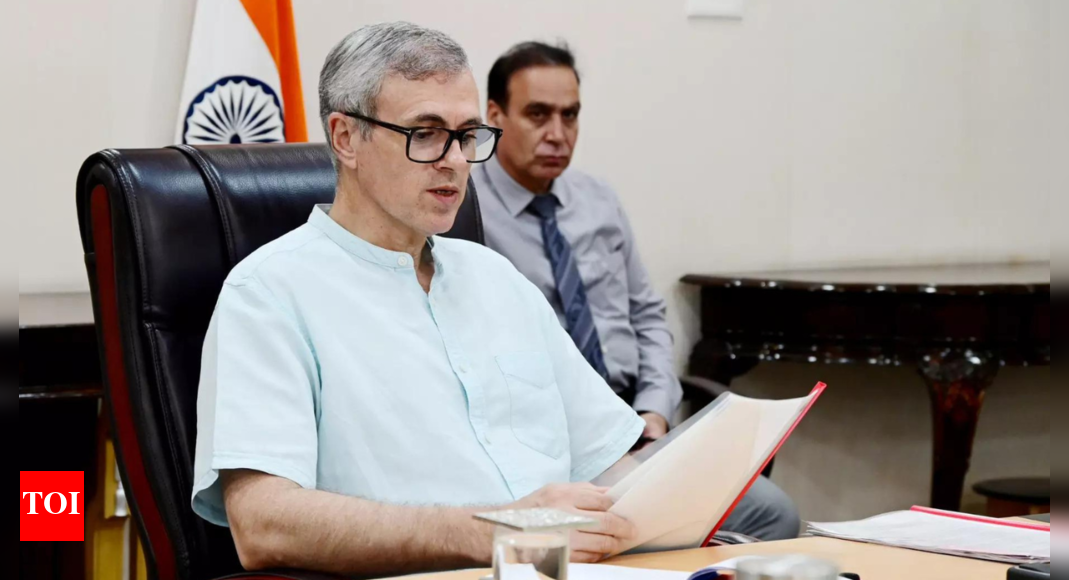

Union Commerce and Industry Minister Piyush Goyal recently addressed the issue during the FTII: Traders Conclave - 2025 in Srinagar. He acknowledged that several delegations brought the matter of GST on handicrafts and handlooms to his attention and suggested they formally appeal to the Finance Ministry. Goyal expressed his support for reducing the GST rate on these items from 12% to 5%, emphasizing that it would significantly boost the handloom and handicraft sectors, especially in J&K.

Currently, different GST rates apply to various handicraft items. For instance, carpets are taxed at 5%, while shawls face a 12% GST. The J&K government is seeking uniformity in these rates, arguing that handicrafts are essentially a tax on human labor. They emphasize that shawls are as labor-intensive as carpets, justifying the need for a consistent 5% rate across all handicraft products.

The handicraft sector in J&K has a substantial impact on the region's exports. The government has set an ambitious target to increase handicraft exports to Rs 3,000 crore annually by 2029. In recent years, exports have shown steady growth, increasing from Rs 550 crore in 2021-2022 to over Rs 1,200 crore in 2023-2024. Major exports include carpets, shawls, wood carvings, and papier-mâché. The J&K Export Policy aims to leverage the region's strengths and resources to transform it into an export-driven economy, focusing on enhancing the quality and competitiveness of local products.

In addition to the GST reduction proposal, there are other initiatives to support the handicraft sector in J&K. Minister Goyal announced that J&K would soon establish a Centre of Excellence for Packaging and Design. This center will focus on introducing new designs and technologies to better promote local products, including handicrafts, horticulture items, and pashmina shawls. Furthermore, discussions are underway to set up another Centre of Excellence focused on storage technology, cold chain infrastructure, and supporting startups.

The implementation of a uniform 5% GST rate on handicraft items is expected to benefit the approximately 3 lakh artisans working in the sector. By reducing the tax burden and promoting marketability, the government aims to revive the handicraft sector and safeguard the livelihoods of those involved in this heritage craft.