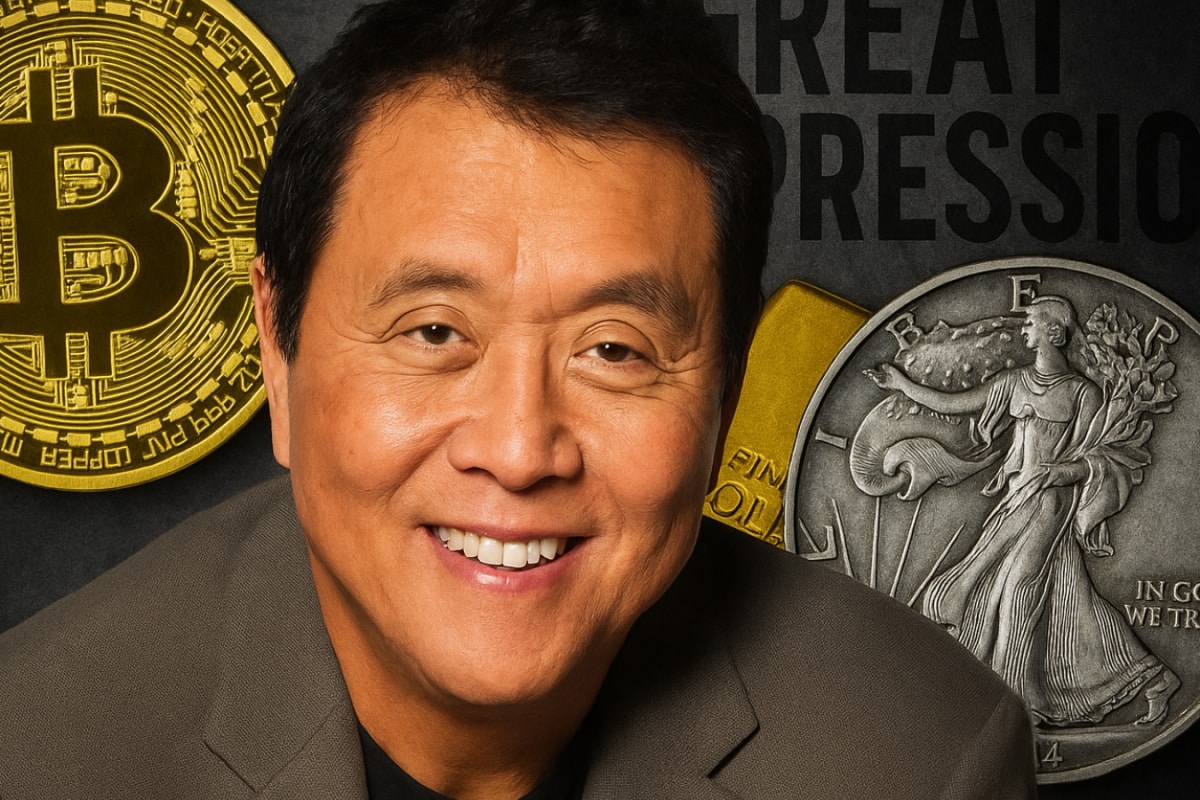

Robert Kiyosaki, the author of "Rich Dad Poor Dad," has issued a warning about a potential stock market crash, while also expressing his preference for alternative investments like gold, silver, and Bitcoin. Kiyosaki has been a long-time critic of the traditional financial system, often referring to fiat currencies as "fake money" eroded by inflation and government policies.

Impending Stock Market Crash Kiyosaki has been predicting a major downturn in the stock market for a while. He has pointed to various indicators suggesting that a crash is imminent, potentially as early as this summer. Kiyosaki has cautioned that this crash could negatively impact many investors, especially baby boomers who rely on 401(k) retirement accounts. He suggests that traditional portfolio allocations are particularly vulnerable during the late stages of the market cycle. While he predicted in February 2025 that the "greatest stock market crash ever was on the way", he has made similar predictions in the past that did not come to pass.

"Real Money": Gold, Silver, and Bitcoin As a countermeasure to the risks he sees in traditional markets, Kiyosaki advocates for investing in what he considers "real money": gold, silver, and Bitcoin. He views these assets as hedges against inflation, fiat currency devaluation, and government control. Kiyosaki believes that precious metals and Bitcoin can protect wealth during economic uncertainty.

Kiyosaki sees Bitcoin as a modern-day digital gold, while gold and silver have been reliable stores of value for centuries. He has also suggested that Bitcoin could reach $1 million by 2035 as the U.S. dollar loses value due to inflationary monetary policies. Despite anticipating a potential Bitcoin crash to $90,000 in August, he views it as a buying opportunity.

Investment Strategies Kiyosaki advises investors to shift their savings into real assets to avoid inflation and protect their value. He suggests that during a market crash, assets like real estate, stocks and other assets go on sale. He has also emphasized the importance of financial education, urging people to understand the difference between real and fake money. Kiyosaki is not alone in expressing confidence in Bitcoin's future. In February 2025, ARK Invest CEO Cathie Wood said that Bitcoin could hit $1.5 million by 2030 if demand for the digital asset continues to grow.

Contrasting Views It's worth noting that Kiyosaki's views are not universally shared. Some investors, like Warren Buffett, are not as enthusiastic about gold and Bitcoin, considering them unproductive assets. These differing opinions highlight different investment philosophies, with some prioritizing inflation-proof assets and others focusing on value-driven businesses.