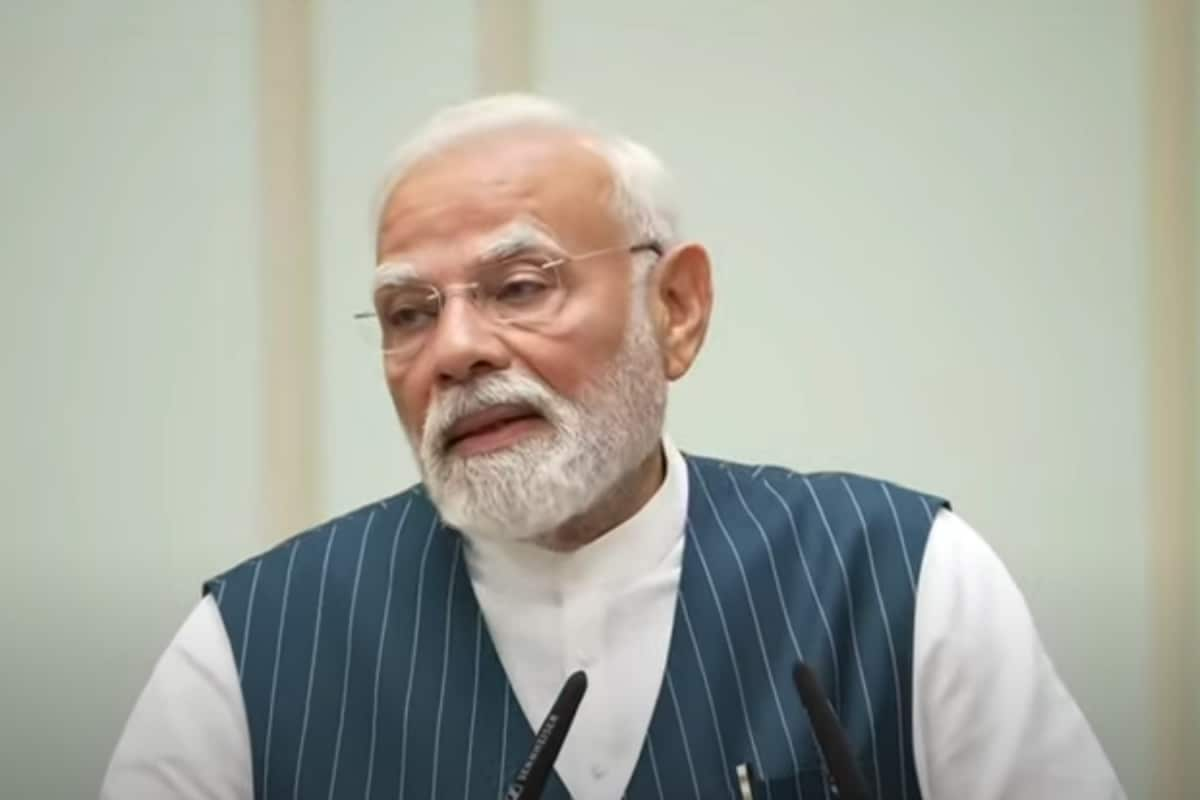

Prime Minister Narendra Modi has strongly criticized the Congress party for what he described as excessively high taxes on essential goods during their time in power. Speaking on the recent Goods and Services Tax (GST) rationalization, Modi asserted that the Congress-led governments previously taxed a wide range of items, including daily necessities, food, medicines, and even children's toffees, and that if his government had done the same, critics "would've pulled my hair".

Modi's remarks came after the GST Council's announcement of a significant overhaul of the GST structure, which included reduced tax rates on numerous items such as food, medicines, essential goods, farm products, green energy equipment, and smaller vehicles. The Prime Minister hailed the GST reforms as a "double dose of support and growth" for India, emphasizing that the changes would benefit various segments of society, including the poor, middle class, farmers, women, students, and youth. He also stated that the new GST rates, set to take effect on September 22, would make many items cheaper, from cottage cheese and shampoo to soaps.

The GST Council's revamp simplifies the previous four-tier tax system (5%, 12%, 18%, and 28%) into a two-rate structure of 5% and 18%. Certain luxury and sin goods, like vehicles, tobacco, and cigarettes, will attract a special 40% tax. Several essential goods will now have a 0% or nil tax rate, with the aim of reducing the burden on consumers.

The Prime Minister framed the GST overhaul as a "Diwali gift" to the people, suggesting it would lead to savings for ordinary households and strengthen the nation's economy. He contrasted this with the Congress regime, which he claimed heavily taxed basic household items, a problem the current government has been trying to rectify to ease the burden on the common person. Modi highlighted that the GST reforms have added five new gems to India's economy. He also referenced his Independence Day speech where he spoke about the importance of next-generation reforms to make India self-reliant and promised a "double blast of happiness" before Diwali and Chhath Puja.

In response to the GST changes, the Congress party has criticized the government, accusing it of celebrating tax collection from the common people. Congress President Mallikarjun Kharge stated that the government had turned "One Nation, One Tax" into "One Nation, 9 Taxes" due to the multiple slabs. The Congress also claimed that it had advocated for a simplified GST system in its 2019 and 2024 manifestos, urging the simplification of GST compliance that has affected MSMEs and small businesses. Congress leader Pawan Khera suggested that the Modi government was belatedly following the advice of Rahul Gandhi regarding GST rates. Former Finance Minister P. Chidambaram welcomed the rate cuts but said that it was "8 years too late".

Despite the opposition's criticism, some state leaders welcomed the GST reforms. Andhra Pradesh Chief Minister N Chandrababu Naidu described the changes as a "pro-poor and growth-oriented decision" that would benefit all sections of society. Trinamool Congress welcomed the revised rates and GST cuts as a "victory for common people" but criticized the BJP-led government for acting only when cornered.