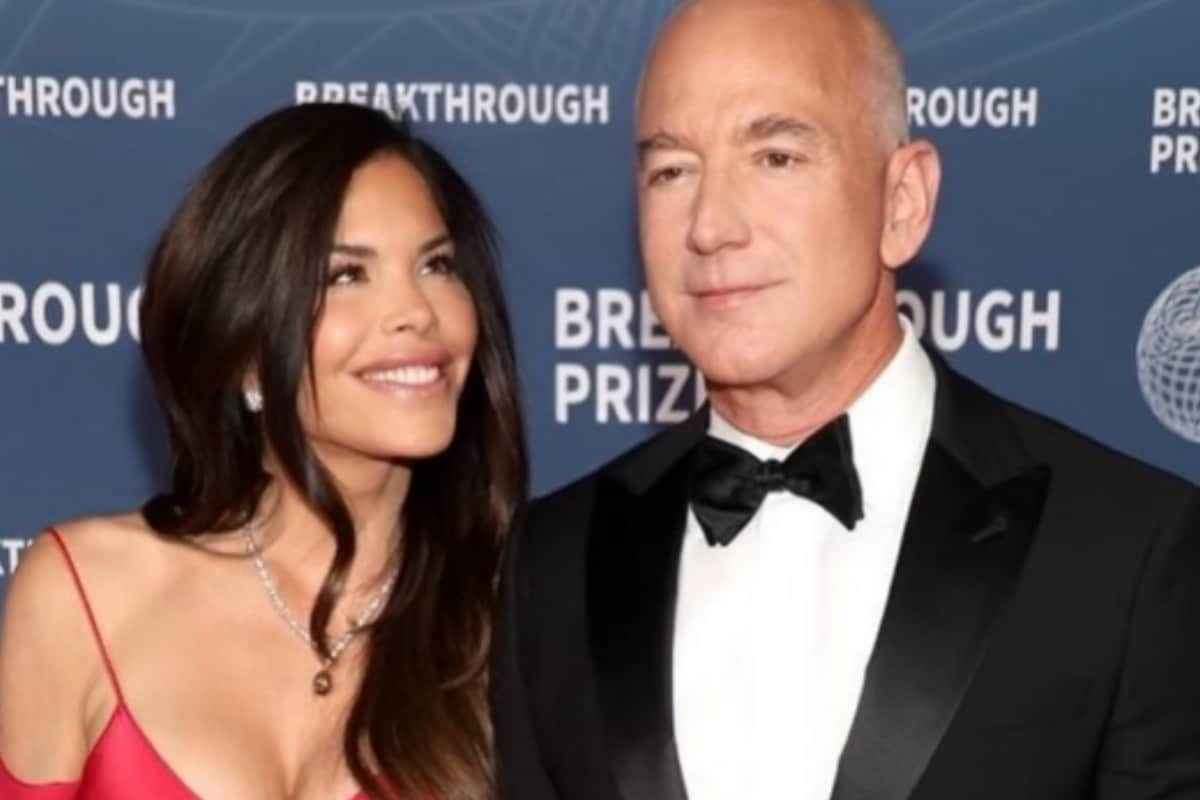

In an era where financial landscapes are increasingly complex and divorce rates remain significant, the question of whether to sign a prenuptial agreement (prenup) is relevant for more than just the ultra-rich like Jeff Bezos. While prenups were once viewed as taboo and reserved for the wealthy elite, they are now gaining traction among individuals of all income levels as a practical tool for financial planning and protection.

A prenuptial agreement is a legally binding contract entered into by two individuals before marriage. It outlines how assets and debts will be divided in the event of a divorce or death. Traditionally, prenups address the ownership of property, assets, and liabilities, and can also specify spousal support arrangements. Some agreements even include clauses related to lifestyle expectations or infidelity, though the enforceability of these varies.

For those not as rich as Jeff Bezos, several compelling reasons exist to consider a prenup.

Protecting Separate Property: A primary benefit is the protection of pre-marital assets. Whether it's a house, savings, investments, or a business, a prenup ensures that what you bring into the marriage remains yours should the marriage dissolve. This is particularly important for individuals who have built up assets independently before marriage or who anticipate receiving inheritances.

Shielding from Debt: Prenups can also shield one spouse from the other's pre-existing debts. Entering a marriage with someone who has significant liabilities, such as student loans or business debts, can put your own assets at risk. A prenup can protect you from being held responsible for those debts in the event of a divorce.

Clarity and Transparency: Discussing a prenup necessitates open and honest communication about finances, which can strengthen a relationship. By disclosing assets, debts, and financial expectations upfront, couples can avoid misunderstandings and conflicts down the road.

Protecting Business Interests: For business owners, a prenup can be crucial for protecting their business interests. Without a prenup, a business could be considered marital property and subject to division in a divorce, potentially disrupting operations and financial stability.

Planning for the Future: A prenup allows couples to define their financial expectations and responsibilities during the marriage. This can include decisions about joint versus separate bank accounts, how income and expenses will be shared, and even savings goals.

Second Marriages and Blended Families: Prenups are particularly beneficial in second marriages, especially when children from previous relationships are involved. They can ensure that assets are protected for the benefit of those children, safeguarding their inheritance rights.

While prenups offer numerous advantages, it's essential to acknowledge potential drawbacks.

Perception of Distrust: Discussing a prenup can be uncomfortable and may create the perception of distrust or a lack of commitment. It's crucial to approach the conversation with sensitivity and transparency, emphasizing the prenup as a tool for planning and protection rather than a sign of impending doom.

Cost and Complexity: Drafting and reviewing a prenup involves legal fees, which can be a significant expense. Additionally, prenups can be complex legal documents, requiring careful consideration and negotiation to ensure fairness and enforceability.

Limited Flexibility: Once signed, a prenup can be challenging to modify, even if circumstances change significantly. This lack of flexibility can be a disadvantage if, for example, one spouse sacrifices career opportunities to support the family.

Enforceability: While prenups are generally enforceable, they can be challenged in court if deemed unfair, unreasonable, or if there was a lack of full financial disclosure.

Ultimately, the decision of whether to sign a prenup is a personal one. While it might not be the most romantic conversation to have before marriage, it can be a practical and responsible step for couples of all financial backgrounds.