The Bharatiya Janata Party (BJP) is attributing the recently implemented Goods and Services Tax (GST) 2.0 reforms to the leadership of Prime Minister Narendra Modi. This sentiment was strongly echoed during a "Sansad Karyashala," a workshop organized for BJP Members of Parliament (MPs). During the workshop, a resolution was passed that lauded the government's efforts in simplifying the tax system and placing the citizen at its heart.

The GST 2.0 reform, approved by the GST Council on September 3, 2025, and set to roll out from September 22, 2025, is being hailed as a landmark moment in India's tax journey. It represents the most significant transformation since the original GST implementation in 2017. The core of these reforms revolves around structural changes, rate rationalization, and procedural simplification. A key feature of GST 2.0 is the simplification of the tax slab structure, moving from a multi-tiered system to a streamlined two-tier structure of 5% and 18%, with an additional 40% rate for luxury and sin goods.

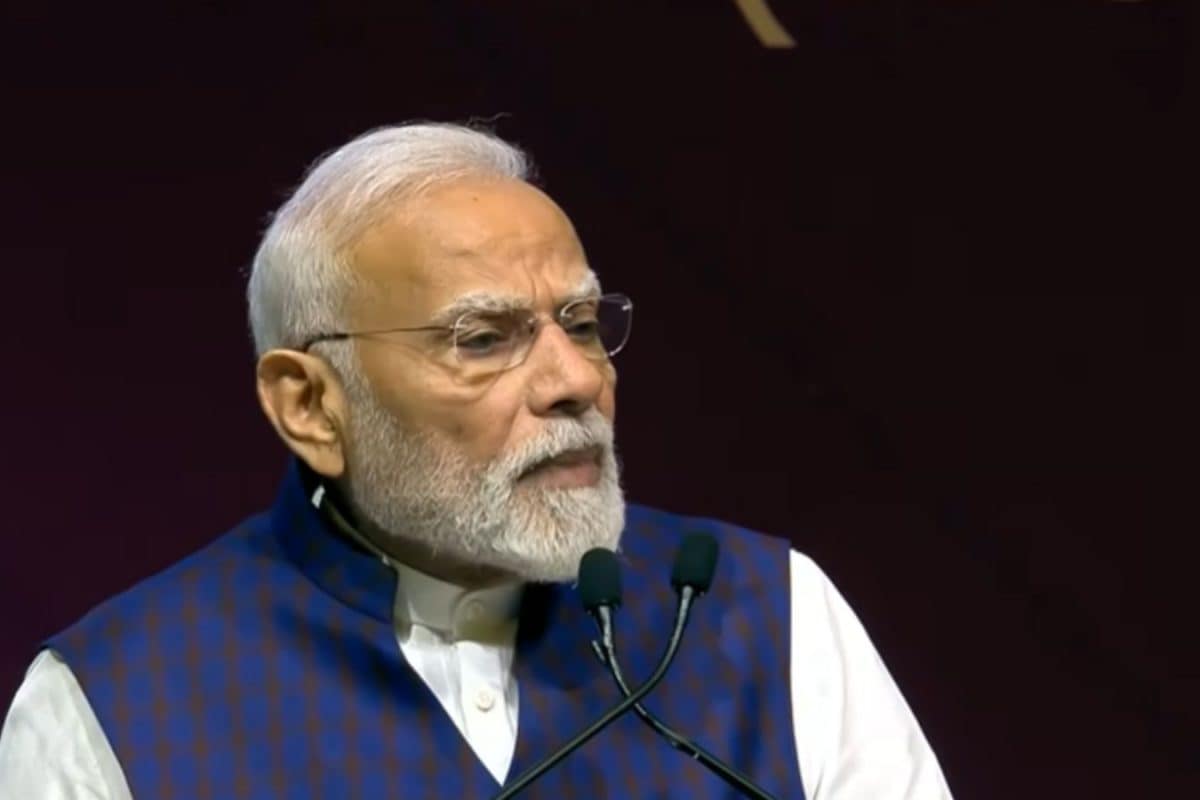

The BJP views these reforms as a major achievement, with several members highlighting that PM Modi chose to sit in the last row like an "ordinary" party member during the Karyashala. The Prime Minister also emphasized the importance of such platforms for learning from each other and deliberating on how to better serve the people.

The resolution passed at the Karyashala also urged manufacturers and traders to pass on the benefits of the GST reductions to consumers. This call for fairness aims to translate the reforms into tangible benefits for every family in India, fostering greater demand and a more prosperous economy, aligning with the vision of "Aatmanirbhar Bharat".

The government has also emphasized that items of daily use will become cheaper, presenting the reforms as a pre-Diwali gift. Essential medicines, life insurance premiums, and health insurance are expected to become more affordable, potentially widening coverage and access to healthcare. The new GST structure isn't just about changing slabs, it has real economic consequences. Experts estimate that GST 2.0 could reduce inflation, as lower taxes on essentials and consumer goods will pull down overall price levels.

The BJP believes that the GST reforms will serve as a catalyst for economic development. The simplified tax structure will encourage greater formalization of businesses, expand the tax base, and improve revenue collection efficiency over time. The reforms are also expected to boost manufacturing competitiveness by reducing input costs and eliminating tax-related distortions in production decisions, alongside improving export competitiveness through a streamlined refund mechanism.

The implementation of GST 2.0 has already led to significant reductions in car prices across India, with major manufacturers announcing price cuts. Buyers can now save a considerable amount, depending on the model.

While the BJP is optimistic about the electoral gains from the GST overhaul, the opposition acknowledges that the reforms could give some buoyancy to the Modi government's popularity. However, they also believe that the political gains will be limited and temporary.