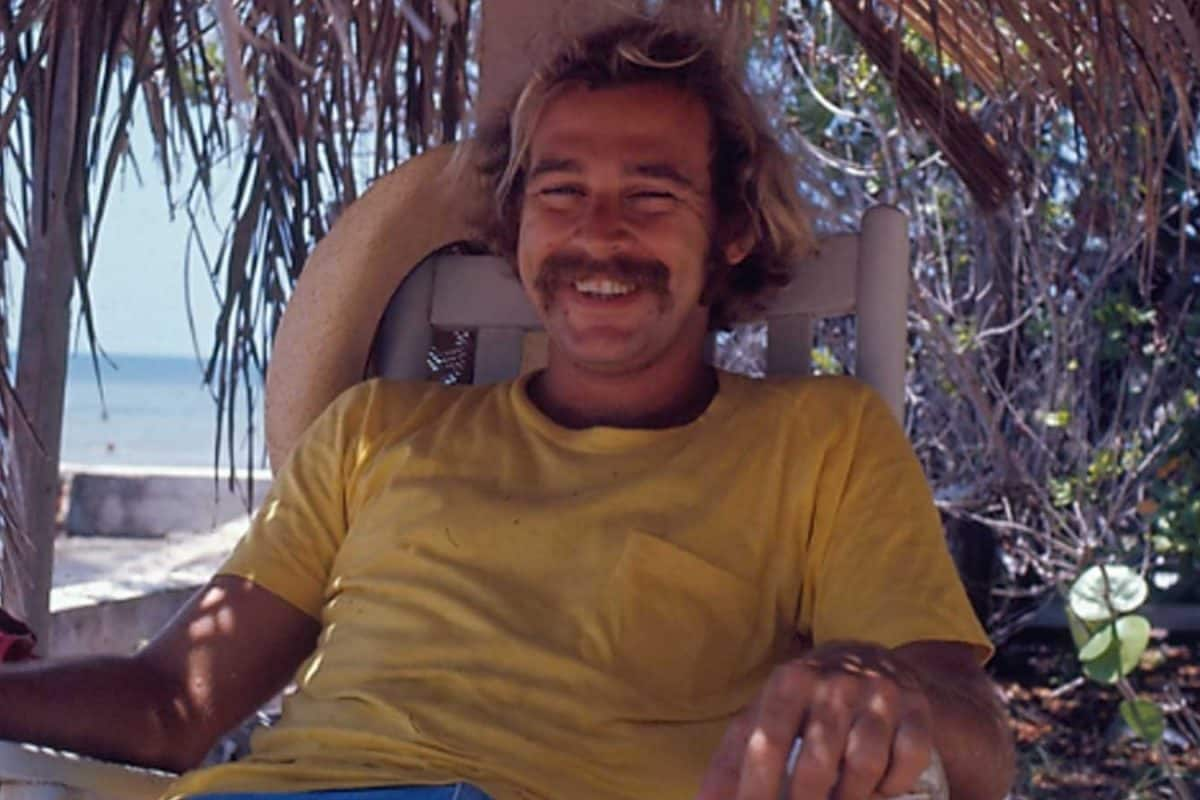

The estate of the late singer-songwriter and businessman Jimmy Buffett has become the subject of a legal battle between his widow, Jane Buffett, and his former business manager, Rick Mozenter, over a $275 million trust.

Jane Buffett filed a lawsuit in Los Angeles Superior Court on Tuesday, June 3, 2025, seeking to remove Mozenter as co-trustee of the estate. She accuses him of mismanagement, withholding crucial financial information, and acting in a hostile and adversarial manner toward her. According to the filing, Mozenter has "failed to perform even the most basic tasks" expected of him, leaving Jane "in the dark" regarding her own finances. Her lawyers further claim that Mozenter "belittled, disrespected and condescended to Mrs. Buffett" when she requested information. She is asking the court to replace Mozenter with Daniel Neidich, a seasoned real estate investor and CEO of Dune Real Estate Partners.

Mozenter, an accountant at Gelfand Rennert & Feldman, had been Buffett's trusted financial advisor for over 30 years. He was appointed co-trustee after Buffett's death in September 2023. However, Mozenter filed a countersuit in Florida on Monday, June 2, requesting Jane's removal as co-trustee, alleging that she has interfered with the trust's proper function, disrupted decision-making, delayed processes, and caused financial harm. Mozenter's petition asserts that Buffett intentionally limited Jane's control over the trust, concerned about her ability to manage the assets. His attorneys state that Jane's anger over this perceived lack of control has led to hostile behavior and a lack of cooperation.

Jane's complaint states that she met with Mozenter a month after her husband's death, seeking clarity on the expected annual income from the trust. However, she claims Mozenter "dragged his feet" for 16 months, repeatedly ignoring her requests. When he finally provided an estimate in February 2025, Jane was told she would receive less than $2 million annually, which her lawyers argue is insufficient to cover her expenses and a "remarkably poor return" for an estate of this size. The filing also notes that Mozenter's company has already been paid $1.75 million for their services.

According to Jane's filing, Jimmy Buffett created a series of trusts over the years to protect his family after his death. Jane was made the sole beneficiary of a marital trust holding the bulk of his assets, including real estate and a 20% stake in Margaritaville. The couple's three children, Savannah, Delaney, and Cameron, each have a one-third share of the remaining Federal estate tax exemption, worth approximately $2 million each.

A close friend of the Buffetts told PEOPLE that Jimmy "would never have wanted Jane to be treated like this" and emphasized the strong bond and trust between them throughout their 46-year marriage.

The dueling lawsuits paint a picture of a deeply fractured relationship between the co-trustees, raising questions about the future management of Buffett's vast estate and the Margaritaville empire he built. The legal proceedings are ongoing in both California and Florida.