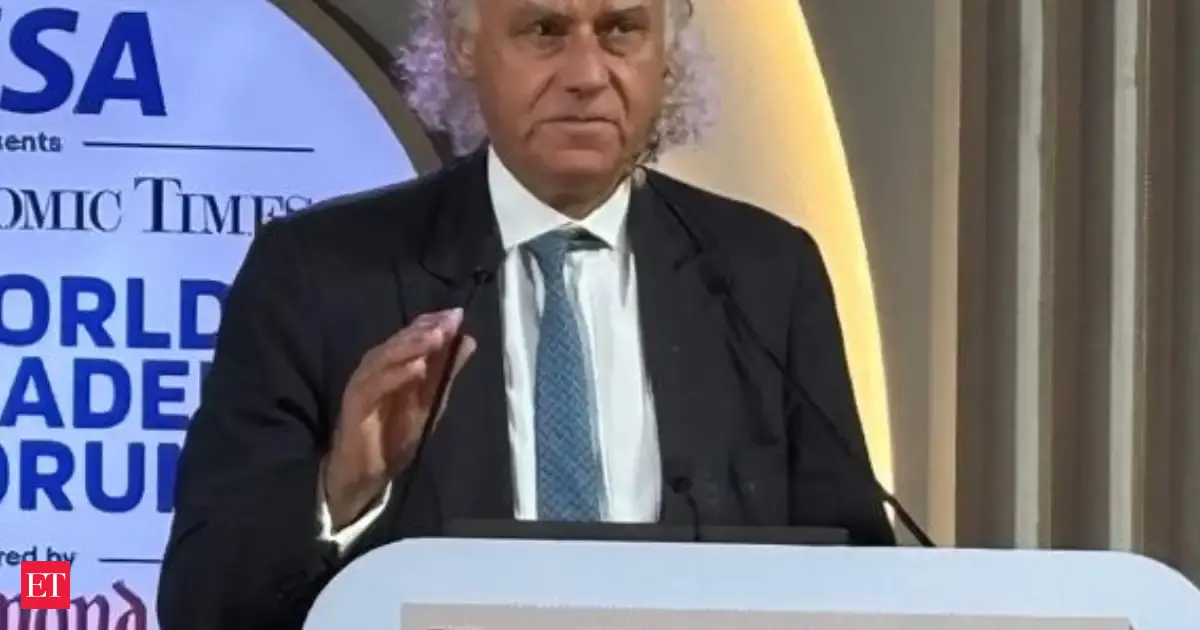

India's long-term market story remains robust, according to Christopher Wood, Global Head of Equity Strategy at Jefferies. Speaking at the ET World Leaders Forum (WLF) on Asia's equity outlook, Wood asserted that India is "the best stock market in the long-term stock market story in the world".

Several factors underpin Wood's bullish outlook. He highlighted India's strengths in wealth management, consistent fund inflows, and the trend of easing interest rates. These elements create a favorable environment for sustained market growth. Wood has also previously pointed out that India's current economic position is similar to China's at the beginning of the 20th century, citing GDP per capita and a dynamic entrepreneurial culture as key drivers.

While optimistic about India, Wood also cautioned about potential risks in the United States, including tariffs, short-term debt funding, and an AI investment bubble. These concerns have led him to recommend reducing exposure to US equities in favor of European, Chinese, and emerging market stocks.

Despite high valuations and lagging private sector investment, Wood remains confident in the Indian market's potential. He has, in the past, advised investors to increase their exposure to the Indian stock market and to "buy the dips" with a long-term focus. He has also noted that emerging market investors are only marginally overweight in India, not due to a lack of confidence, but because of high valuations driven by domestic money, which he sees as a good opportunity for long-term investment.

Wood's positive stance is further reflected in recent portfolio adjustments. He has increased his exposure to Indian real estate and online travel stocks, along with Reliance Industries, while trimming stakes in select banking and technology names. This includes increasing investments in companies like Macrotech Developers, DLF Limited, and MakeMyTrip. These moves indicate a strategic shift towards growth-oriented and consumer-facing Indian stocks.

In summary, Christopher Wood's continued confidence in India's long-term market story is based on a combination of strong domestic factors and a cautious view of potential risks in other markets. His advice to investors is to focus on the long term and take advantage of opportunities to increase exposure to Indian equities.